This story is part of your SHN+ subscription

The active adult sector has significantly expanded in the last few years, but a recent NIC report shows there is still much more room for growth on the horizon.

New data released by the National Investment Center for Seniors Housing & Care (NIC) earlier this month caught my eye. According to the industry association, there are currently 800 active adult properties housing 118,000 units in the U.S., which carry an average stabilized occupancy rate of 96%. That demand, plus the still relatively small size of the active adult sector compared to the senior living industry’s more than two million senior living units, tells me there is much more room for growth for those companies. And indeed, that was the conclusion of NIC Senior Principal Caroline Clapp, who said that “the active adult rental market is still in its early stages” with average penetration rates of only as high as 2% in certain markets.

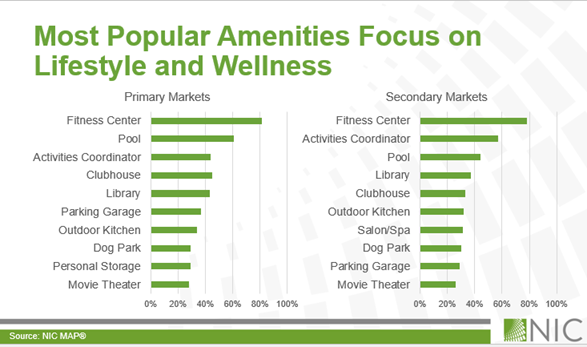

Last year, SHN Senior Editor Tim Regan covered how active adult operators are divining the needs and wants of younger older adults and offering them amenities and services they desire. Residents most often desire fitness centers, pools, clubhouses, and activities coordination, indicating “strong interest in lifestyle, engagement, and wellness,” Clapp wrote in NIC’s recent report.

Active adult communities also are cheaper than any other rung on the senior housing care continuum, with median rates in large metro areas between just below $2,500 in Denver to about $3,500 in Miami.

Putting all the pieces together, I think active adult communities still have a strong value proposition among the incoming boomer generation, just as they have in recent years. Longer-term, I think the product type’s current demand underscores the challenge that senior living operators elsewhere on the continuum might have when these residents need a higher level of care in the years to come.

In this members-only SHN+ Update, I analyze recent NIC MAP data and other recent reporting to offer the following takeaways:

- Inside the growth of the active adult market in 2025

- The driving forces behind increasing active adult demand

- Why senior living operators could struggle to attract current active adult residents down the road

Active adult demand continues to surge as sector grows

The active adult product type has surged with demand in the last 12 months. Comparing NIC MAP data from last October and now, the industry has added about 2,000 active adult units, a slightly higher number than the 1,890 senior living units that came online in that time.

Companies forging ahead in the active adult space include United Properties, which is adding 30 new villas to its Amira Villas Minnetonka active adult community in Minnetonka, Minnesota. United Properties opened the community in 2023 and had originally planned for an extended stay hotel on the site of its new villas, but shifted those plans based on red-hot demand for the product type, according to Vice President of Senior Living Development Dave Young.

“We feel it’s provided a niche in the market for an ever-growing demographic so we are continuing to pursue the Amira product in the Minnesota and Colorado markets,” Young told SHN in January.

Similarly, developer Avenue in April opened its first Viva Bene community in St. Louis, with plans to expand the brand from there. The brand’s model rests on pairing active adult units and a wellness hub with resident access to preventative health thanks to a partnership with Sevi Health.

“Viva Bene changes the senior living paradigm by incorporating early access to care navigation and chronic care management. It’s about proactive prevention and infusing wellness into everyday life so people can thrive,” Viva Bene co-founder and Avenue principal Laurie Schultz said at the time.

Both companies’ models are aimed at attracting older adults who want to rent rather than own a home or make an early move into independent living.

It’s not hard for me to imagine why active adult operators have grown those kinds of models for the boomer crowd. Older adults between the ages of 65 and 74 made up about 10% of total renters in 2023, representing the fastest-growing age group among older adult renters. NIC noted there is a “notable rise in gray divorce” among older adults 50 years old or older, after which they are more likely to rent an apartment than move into senior housing.

Older adults of the baby boomer generation also desire amenities that emphasize lifestyle and wellness, such as fitness centers, pools, clubhouses, libraries and dog parks. And they are now the wealthiest generation in terms of median net worth, with a median net worth of a little more than $200,000. That is “further fueling demand for high-quality properties with resort-like amenities,” according to Clapp.

Active Adult Rental Communities: Data Dive via NIC MAP

Active Adult Rental Communities: Data Dive via NIC MAPAdditionally, these products are newer on average than their senior living counterparts, with a median community age of 10 or fewer years old compared to senior living communities, which carry a median age of 21 years. Roughly a third of all active adult communities have opened since 2020, according to NIC MAP.

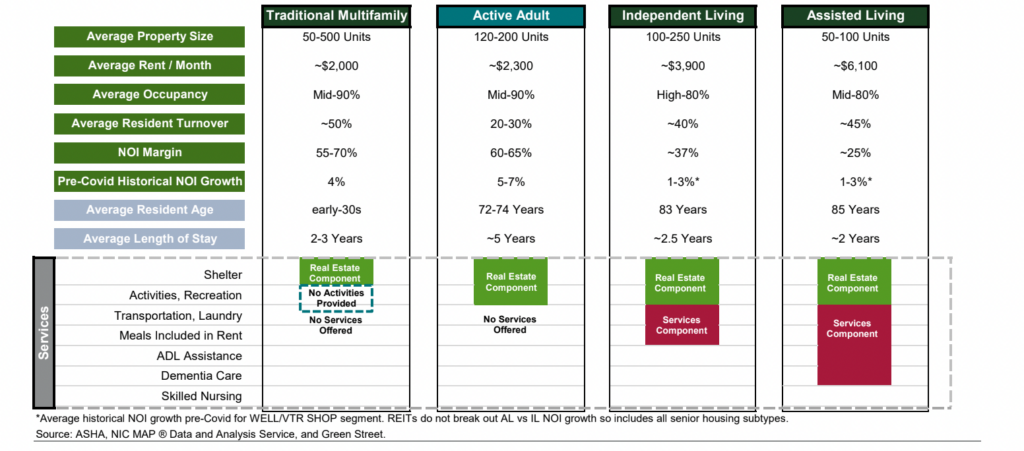

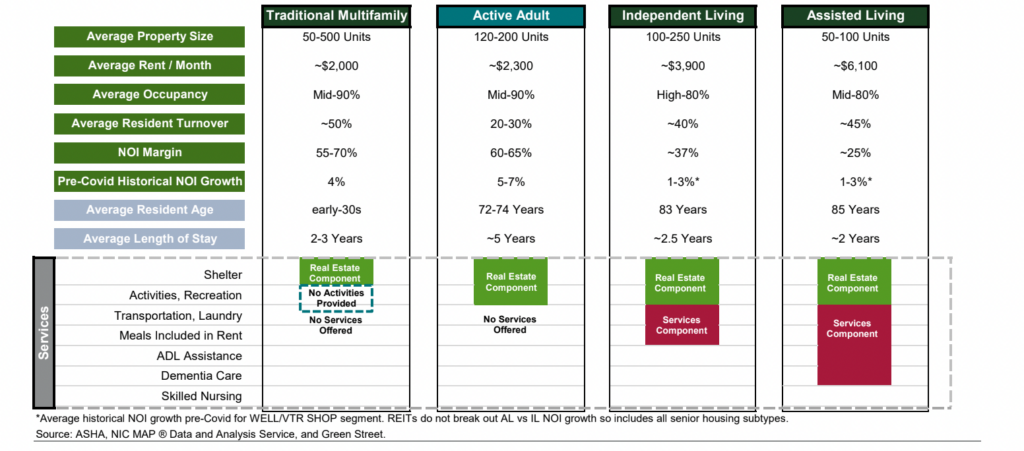

While they offer residents far fewer services, active adult communities are cheaper than independent living communities. According to NIC data cited by ASHA’s Where You Live Matters website, the average cost of independent living in the U.S. is around $3,800 per month. That is still higher than the most expensive average monthly rent for an active adult unit of$3,500 per month in Miami.

Other markets carry monthly rent even lower than that. On average, active adult units in San Antonio, Texas, and Denver, all charged less than $2,500 per month. According to a 2024 Green Street report, active adult rents “garner a 30% [to] 50% discount and provide a much higher NOI margin due to the lack of services and operational intensity relative to senior living.”

July 12, 2024 “Health Care Insights” report from Green Street

July 12, 2024 “Health Care Insights” report from Green StreetAccording to Green Street’s analysis, more than three-fourths of prospective active adult residents can afford their rent without relying on savings.

“With 80% to 90% of residents typically retired, and a majority of those receiving social security retirement benefits (~90% of retirees receive benefits), the ability of residents to pay for active adult communities screens quite favorably,” the Green Street report reads. “De minimis bad debt, regardless of the economic environment, makes it a fairly defensive property sector relative to most.”

Putting all of the pieces together, it’s clear to me that the active adult sector has a long runway for growth in the years ahead and lots of room to grow, and that was also Clapp’s opinion.

“Penetration rates are well below those of traditional senior housing, indicating potential opportunity for further development depending upon the market and submarket,” she wrote. “Investors and developers should conduct in-depth research and ensure thorough due diligence when entering a new market, striving to keep lifestyle and engagement at the core of lease-up and operations.”

A common refrain in senior living is that today’s independent living is yesterday’s assisted living. I think that way of thinking also applies to the active adult sector, which today resembles the industry’s original independent living model born in the ‘90s.

No doubt these conditions are good for active adult companies with well-thought plans. But I also think active adult growth could squeeze independent living operators, which in 2025 are reporting that residents who used to move into independent living are now skipping over the product type entirely.

The challenges of differentiation

While they are fairly different from one another by way of services, independent living and active adult operators are still similar enough that they can attract many of the same customers.

I see two big challenges arising out of that trend for independent living operators: that residents will age in place in active adult communities, and that future baby boomers could choose to skip independent living for a higher level of care once they need it.

For example, residents move into Scottsdale, Arizona-based Cogir Senior Living’s communities at a later stage than they did prior to the Covid-19 pandemic. As they do so, they are bypassing independent living and moving into assisted living or memory care, according to COO Gottfried Ernst.

While that trend isn’t directly related to active adult communities, I think a similar phenomenon could play out in active adult as the product type grows. As SHN has written about before, I think there is a possibility that residents will age in place for as long as they can, given the lower cost of that setting and their desire for independence. Then, when they can’t live in their apartments anymore, they will move into assisted living or another care level.

To be clear, Green Street believes “acuity creep” – as the phenomenon is called – is only a “low” risk for active adult companies. But I think that the rise of active adult makes it even more important for independent living and other operators to differentiate their services as much as possible.

One recent trend is blending independent living with more proactive wellness or preventative health services. Residents of those kinds of communities wouldn’t necessarily move into them because of beautiful grounds, luxurious food or other amenities, and instead choose them for how successfully they can help residents maintain wellness in the years to come or how they can make them feel “at home.”

Complicating that is the fact that senior living communities are aging and growing more obsolete while development remains at a near-standstill. That’s not to say operators won’t be able to differentiate themselves from newer, potentially more attractive active adult communities, but my point is that independent living operators likely will have to be creative in order to stand out in the future.