The costs and consumer appeal of senior living communities versus receiving at-home care have been big themes in the last few weeks.

This week, a new ASHA report revealed something that I think many operators already know: The cost of senior living is not all that much higher than the average cost of living at home and hiring a caregiver, and may even be lower in some cases. And that report comes on the heels of a Wall Street Journal story detailing the “crushing financial burden” that older adults face as they age at home.

This all might sound like good news for the senior living industry. But these pieces also highlight a troubling sticking point for the sector: despite the enormous costs of home care and the efforts of senior living providers to educate and draw in consumers, many older adults are still choosing to live at home versus senior housing, sometimes even in dire financial situations.

Evidence as to why may be found in the WSJ article, which shared the personal accounts of a handful of older adults struggling to pay for in-home care or other kinds of help as they age in residential dwellings.

In one instance, a woman said she almost moved her husband into a memory care community, but chose not to after seeing the community firsthand. Another woman pushed off her own retirement to take care of her wife, who is living with dementia.

The article includes other stories that help convey the many reasons that older adults choose to live at home beyond cost, including familiarity, security and comfort.

But make no mistake, the cost of senior living is also a big factor in that decision, and I think the industry will have to do a better job communicating the cost of congregate living versus living at home. I also think senior living operators will simply need to do even more to make their services more affordable for a wider swath of older adults if they hope to break the longstanding perception that senior living communities are prohibitively expensive.

In this members-only SHN+ Update, I analyze the recent ASHA report and Wall Street Journal stories and offer the following takeaways, including:

- Comparing the cost of living at home to senior living

- Why some older adults may still choose to live at home despite the “crushing” costs

- How operators can make the favorable financial math more apparent with prospects

Inside the cost of living at home with care

Operators have long been wary of “sticker shock” in new prospects who see the cost of senior living. It’s a common practice during the sales process to compare the cost of senior living to the cost of living at home to show prospects they aren’t all that far apart – and the new ASHA report should lend communities more evidence in that effort.

The report, an updated version of one released in 2017, detailed the “surprising” cost of living at home with home health care and senior living. The report was authored by Daniel Bernstein, who formerly worked as an industry analyst at Stifel and Capital One.

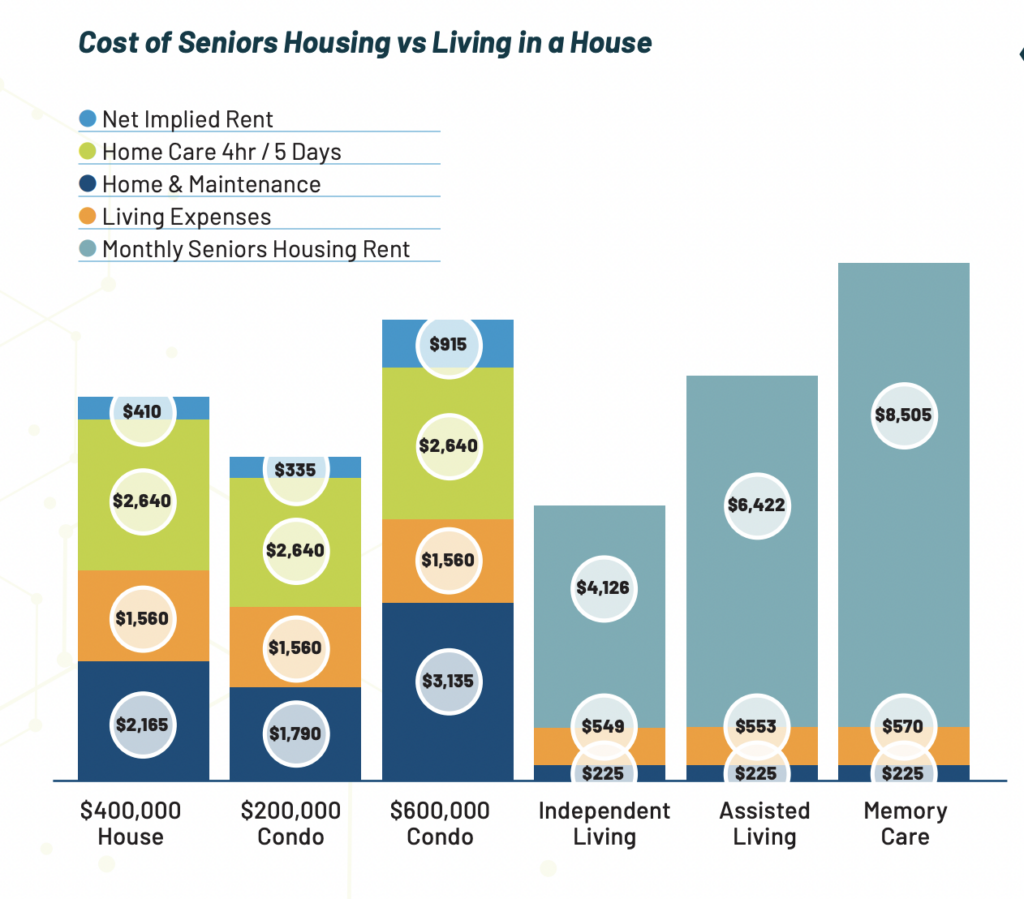

According to the report, an average older adult living in a $400,000 house without a mortgage can expect to pay about $3,725 a month in basic living expenses stemming from HOA payments, maintenance costs, property taxes and insurance, housekeeping services, socialization and entertainment, home security, transportation, utilities and three meals a day.

At first glance, that cost is lower than what older adults can expect to pay for a senior living community – indeed, “it is this $3,725 cumulative figure – or something lower because the senior in question has curtailed her social, entertainment and transportation expenses – that most seniors and their families compare to the $4,900 to $9,300 monthly cost of seniors housing,” Bernstein wrote in the report.

But that cost of living at home does not include the price of home-based care, which combined with net implied rent can push costs up to $6,775 a month. As such, older adults who use “even a modest level of home health care” can find they are paying as much as it would cost to live in an independent living community, according to the report.

Furthermore, older adults have grown their net worth since 2017, primarily linked to higher home prices. The median wealth of someone 75 or older was $237,900 in 2017 and $315,900 in 2021. Bernstein used U.S. Census data to extrapolate that median net worth for the cohort rose to $374,000 in 2023.

When taking into account the pace of senior living rate increases in the last few years, that math “strongly suggests affordability has improved by 27 percent, 23 percent, and 22 percent for IL, AL, and memory care.”

On paper, that should give operators plenty of evidence to show prospects the true cost of senior living compared to living at home – but as operators well know, there is more to the conversation than that.

‘Home is your anchor’

The math demonstrating the similar costs of senior living and aging at home with care leads me to a question that I think a lot of other operators have asked in recent years: Why are older adults still choosing to live and age at home, as reflected in stubbornly fixed senior living penetration rates?

One reason may be that they don’t totally understand all of the costs they incur living at home. Amy Goyer, a family and caregiving expert with AARP, told the Wall Street Journal that independence and familiarity are two big reasons older adults decide to age in place at home. But “they think about medical costs. They don’t think of paying for the roof over their heads,” she told the Journal.

But the situation is obviously more complicated than dollars and cents.

The Wall Street Journal detailed the story of San Francisco Bay Area older adults Cheryl Orr and her wife, Joyce Penalver, who is living with Alzheimer’s. Their monthly expenses are between $4,000 and $5,000 after mortgage, car payments, and some help with home health.

“Home is your anchor, where your stuff is, where your memories are,” Orr told the Wall Street Journal. “We really want to stay here. I just hope we can.”

Another couple, Jimmy and Christine Salhany, actually had toured a memory care community with “a good reputation and an available room with a view of the garden.” But on a visit prior to Salhany’s move-in day, they spotted ”people sitting at tables sleeping with their heads down or staring into space.”

“I couldn’t do it,” Christine Salhany told the Wall Street Journal. “I am not ready to let go of Jimmy’s care and lower my standards.”

I think these examples all represent the thought process of many older adults right now, especially those living in situations where one needs more care than the other.

For one, I think it’s notable that Salhany was afraid of lowering her standards despite visiting a community with a good reputation. Without knowing more about the situation, I wonder if there was more the community could have done to assuage her fears. For example:

- Providing more education around various stages and types of dementia, to provide context for behaviors that they might see residents exhibit

- Connections with family members of residents who would be willing to share their own experiences about making the move-in decision, and their level of satisfaction with the community

- More engagement with Christine Salhany to understand what her standards are for her husband’s care, and discussion around how well the community could meet those standards

It’s no secret that the senior living industry faces an uphill climb with regard to breaking the longstanding stigma of community living. That effort is further complicated by the fact that senior living faces public scrutiny from both the federal government and the media regarding affordability and quality. It is my opinion that operators can and should do more to show they can properly care for an older adult living with dementia.

It’s a daunting challenge and demands more innovation on the sales side. Sales professionals in senior living are being called on to have skills and expertise in financial planning and analysis, psychology, clinical matters, and more.

I go back to what leaders shared at our Sales & Marketing conference earlier this year, about taking a more sophisticated approach in recruiting for particular skillsets and mentalities.

But sales teams can only do so much, if they don’t have the right product for their markets and prospects. If you’ve read my previous SHN+ Updates, then you know I think the industry should move faster in building new middle-market models. The fact is that even if senior living is relatively affordable compared with at-home care, the costs for either option are high and potentially devastating for some people.

At the end of the day, the WSJ article and the ASHA survey drive home the fact that combating the stigma of senior living cannot be waged and won through public awareness campaigns or letters to the editor after unflattering news reports.

It’s not about proving to the public how great senior living already is, but improving sales processes, pricing models, and doubling-down on clinical excellence. Only in this way can senior living providers convince consumers that while their home might be their anchor, it might be an anchor that is holding them back, not just keeping them secure.